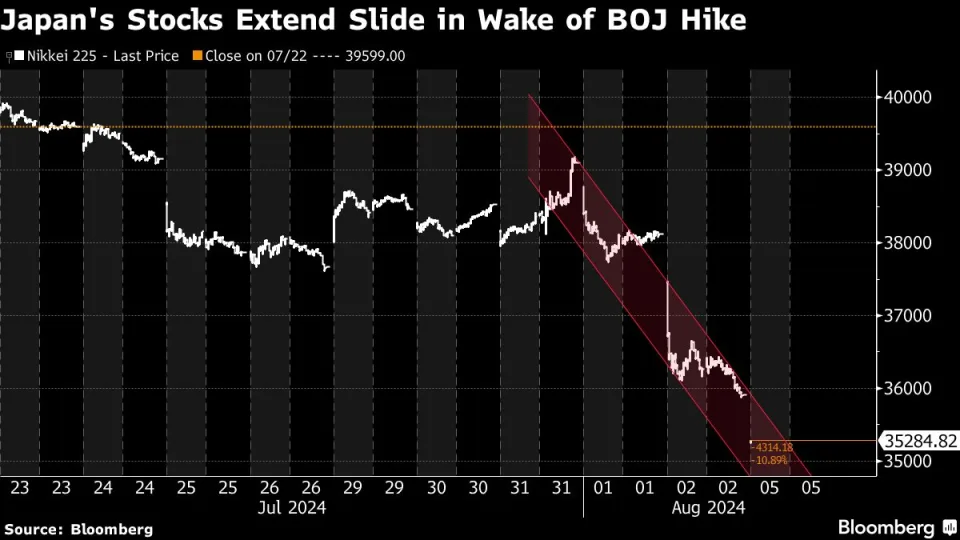

Global Stock Rout Intensifies, Japanese equities goes down

On Monday, investors fled to the shelter of bonds as worries over the Federal Reserve’s perceived policy support for a faltering US economy drove a further selloff of global markets. For a third day, markets priced in further domestic rate rises, which sent Japanese equities down.

Japan’s Top ix index tumbled more than 7%, while the yen rallied over 1% on bets the Bank of Japan will keep raising interest rates after last Wednesday’s hike. Korean and Australian shares slid, while US futures declined by more than 1.5%. With investors concerned the US economy may be in for a hard landing, a rally in Treasuries sent yields to the lowest in more than a year.

The price action underscores how quickly sentiment has shifted away from expectations that the Fed will be able to engineer a soft landing for the US economy. Data on Friday showed that US nonfarm payrolls recorded one of the weakest prints since the pandemic, and the jobless rate unexpectedly climbed to above the Fed’s year-end forecast, triggering a closely watched recession indicator.

“It is certainly a case of a conspiracy of ‘risk off’ triggers,” with the Bank of Japan signaling more tightening and the Fed potentially too slow, said Vishnu Varathan, head of economics and strategy for Mizuho Bank in Singapore. “For now though carry unwind and recession fears are co-conspirators to damage risk appetite.”

The moves in Japanese benchmark indexes drove their drops to more than 20% — a loss that signals a bear market. The three-day losses are the worst since the 2011 tsunami and Fukushima nuclear meltdown.

READ MORE ABOUT THESE YAHOO.FINANCE GOT YOU COVERED